The IRS began accepting tax returns on 🗓 January 29 for the current tax season. The tax filing deadline for federal returns is 🗓 April 15, though residents of Maine and Massachusetts have until 🗓 April 17 to file because of state holidays.

Meanwhile, individuals residing in federally declared disaster areas might receive an extended filing time beyond the standard deadline.

You can also request a six-month tax extension by filing Form 4868 before 🗓 April 15, extending the deadline to mid-October.

Here are the 2024 tax deadlines you need to keep in mind:

Most states align their tax deadlines with the federal date, with some exceptions like Virginia's May 1 deadline, making it easier for taxpayers to file both returns simultaneously.

Here are the states with income tax return deadlines and their respective deadlines.

On the other hand, the states listed below don't have a specific deadline or "tax day" for state tax returns since they don't impose an income tax.

Here are some key points to consider if you cannot meet the 2024 tax deadline:

👉 Request a tax filing extension by submitting Form 4868 to extend the deadline to October 15, 2024.

👉 You can't file an extension past the tax deadline, so file by April 15th.

👉 Filing an extension doesn't delay the requirement to pay taxes owed, so ensure you make any necessary payments on time.

👉 If you're eligible for an IRS refund for your 2023 tax return, you have three years to file before it's turned over to the Treasury.

👉 Be aware of potential late penalties and interest for failing to file or pay taxes by the extended deadline.

The IRS imposes two penalties for late tax filing: a failure-to-file penalty and a failure-to-pay penalty.

The late filing penalty is generally 5% per month or part of a month on the amount owed, up to a maximum of 25%. If your return is over 60 days late, the minimum penalty is $435 or the balance of your taxes due if it's less.

The penalty for unpaid taxes is typically 0.5% of the amount owed, calculated from the deadline. The IRS applies this penalty for each month or part of a month that your payment is late, with a maximum penalty of 25%.

The IRS also charges interest on overdue taxes at a rate of 7%, calculated by adding 3% to the short-term federal interest rate. This rate is adjusted quarterly, and interest is compounded daily.

The 2024 tax bracket has slightly increased income thresholds for each bracket compared to 2023. These tax rates will remain unchanged until 2025 under the Tax Cuts and Jobs Act of 2017.

However, the IRS can adjust income thresholds for each federal tax bracket annually to accommodate inflation.

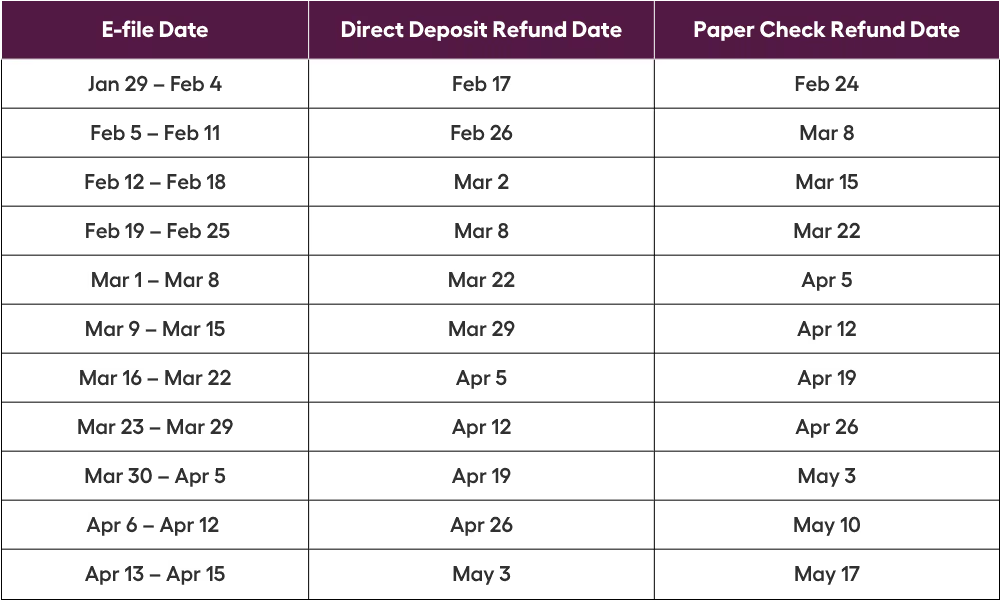

The IRS aims to process e-filed tax returns within 21 days in the 2024 tax season. Taxpayers who file online can expect their refunds within 21 days after the IRS acknowledges their return. Those who file between January 23 and January 28 may be eligible for a refund by February 17.

Here are some essential points to remember about refunds:

To receive an IRS refund, you need to meet the following requirements:

✅ You've paid more in taxes than you owed throughout the year.

✅ You don't have tax debts or offsets. Otherwise, the IRS will use your refund to offset the debts you owe them.

✅ You must be alive. When filing a return for a deceased taxpayer, specific rules apply.

✅ You could get a refund if you claim deductions and credits on your tax return to lower your tax liability.

IRS typically aims to process electronic tax returns within 21 days. The table below shows the tentative refund schedule based on the IRS guidelines.

However, there are some situations where the 21-day timeline doesn’t apply:

🔴 Discrepancies or missing information on your tax return will require manual verification and cause delays in receiving your refund.

🔴 Claiming for refundable credits such as Additional Child Tax Crеdit (ACTC) and thе Earnеd Incomе Tax Crеdit (EITC) may also delay your refund since the IRS needs to verify eligibility.

🔴 Requesting a direct deposit of your refund can also cause delays if there are any issues with the account information provided. In this case, the IRS will issue a paper check instead.

🔴 Tax returns involving self-employment income or foreign assets require more time for processing due to their complexity.

🔴 Filing paper returns instead of e-filing can also result in longer processing times.

Here are the steps to track your refund online:

1️⃣ Visit the IRS website by going to https://www.irs.gov/

2️⃣ Hover over the "Refunds" menu, then click “Where’s My Refund.”

3️⃣ Click the "Check your refund" button.

4️⃣ On the next page, enter your Social Security or individual taxpayer ID number (ITIN), tax year, filing status, and the refund amount shown on your tax return.

The tool will display your refund status, along with:

▶️ Return Received - The IRS has received and is processing your tax return.

▶️ Refund Approved - They've processed your return and approved your refund.

▶️ Refund Sent - A refund cheque is sent or transferred to your bank account.

Note: The refund processing time for it to appear on the website is as follows:

▶️ 24 hours after you e-file a current-year return

▶️ 3 or 4 days after you e-file a prior-year return

▶️ 4 weeks after you file a paper return

Here are essential tips to prevent common issues and refund delays:

According to Mark Steber, the chief tax information officer at Jackson Hewitt, some taxpayers may receive larger refunds this year. Some could get 10% more than last year, approximately $300 to $400.

In 2023, the IRS changed its provisions to account for inflation, resulting in an increased standard deduction and a 7.1% rise in tax brackets.

So, for example, if your wages went up by 4% last year, which is less than the IRS adjustment of 7% to its tax brackets, it could result in a larger refund.

The maximum tax credit for each child under 17 as of December 31, 2023, is $2,000.

However, potential changes are coming for the Child Tax Credit:

▶The House has approved the Tax Relief for American Families and Workers Act of 2024, a bill that aims to expand the credit for parents and extend certain business tax credits. The bill is still awaiting voting from the Senate.

▶ If the Senate passes the new tax deal, the CTC amount will remain $2,000 per child. However, a third adjustment to the credit could result in additional money for more families in their tax refund.

▶ This is due to changes in the partially refundable nature of the CTC, allowing you to receive up to $1,600 back in your annual tax refund if you don't owe taxes or are receiving a refund.

▶ According to the proposed bill, the maximum refundable amount per child would increase to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025.

Although the House has approved the proposed changes in CTC, the Senate has yet to vote on it, which has no definite schedule yet. Until then, you should file your tax return as soon as possible to avoid delays in receiving any potential refund.

Moreover, once the legislation becomes law, the IRS might automatically send you the difference in the child tax credit, or they may ask you to file an amended return, which can be e-filed.

You and your family must satisfy the following criteria to qualify for the tax break.

🟢 Your modified adjusted gross income (MAGI) is $200,000 or less. Or $400,000 or less if you're filing jointly.

🟢 The child you're claiming the credit for was under 17 years old on December 31, 2023.

🟢 The child has a valid Social Security number.

🟢 They are your legally recognized child, stepchild, foster child, sibling, half-brother or half-sister, or a descendant of one of these categories (such as a grandchild, niece, or nephew).

🟢 They have provided less than half of their financial support in the tax year.

🟢 They have been living with you for more than half of the year.

🟢 You are listing them as dependents on your tax return.

🟢 You are a citizen of the United States or a resident alien.

Here are several ways to file your tax return:

If it's your first time filing taxes, here are some tips to keep in mind:

Navigating the tax season doesn't need to be overwhelming. By preparing properly and staying aware of important deadlines and changes, you can have a hassle-free filing experience.

If handling your taxes feels overwhelming, you're not alone. Doing Well provides personalized guidance to help you navigate tax season smoothly. Schedule a free tax consultation call with us today and make this tax season stress-free.