Erika, a 27-year-old esthetician, was trapped in a familiar cycle. Despite running her own business and generating decent income, she couldn't break free from the pattern that had plagued her for years: make money, spend impulsively, rack up credit card debt, pay it off, repeat. Her tough childhood had taught her to work hard, but nobody had ever shown her how to manage what she earned.

"I used to be super stressed about money, always wondering if I was making the right decisions," Erika recalls.

Erika's breakthrough moment came when she realized she didn't want to repeat the financial mistakes that had cost her in the past. She had cycled through credit card debt multiple times, had no emergency savings, and was spending $5,000 a month with little to show for it. The stress was overwhelming, especially knowing she would eventually need to care for her aging father.

"I wanted to get better with my money because I didn't want to make major financial mistakes like I did in the past," she said. Even though she wasn't sure if coaching could help, she knew something had to change.

Sharing her money story

Erika opened up about her financial history and how her tough childhood experiences shaped her money mindset. Her Doing Well coach listened to her story of growing up in a financially unstable household and the patterns of financial stress it created. This was her space to bring all her questions about budgeting, debt, and breaking free from the cycle.

Categorize: The reality check

Together, they reviewed all her accounts - bank, credit cards, and expenses - to understand her true financial picture. The shocking discovery came when they categorized every expense: $1,400 monthly on eating out and shopping, plus forgotten subscriptions adding up. This step revealed where her $5K monthly spending was actually going.

Budget: Creating sustainable habits

With her complete financial picture clear, they analyzed Erika's income and expenses to create a sustainable budget. She conducted a massive subscription review, canceling unnecessary services, and set up automatic bill payments to avoid the late fees that had been fueling her debt cycle.

Plan: Building her action plan

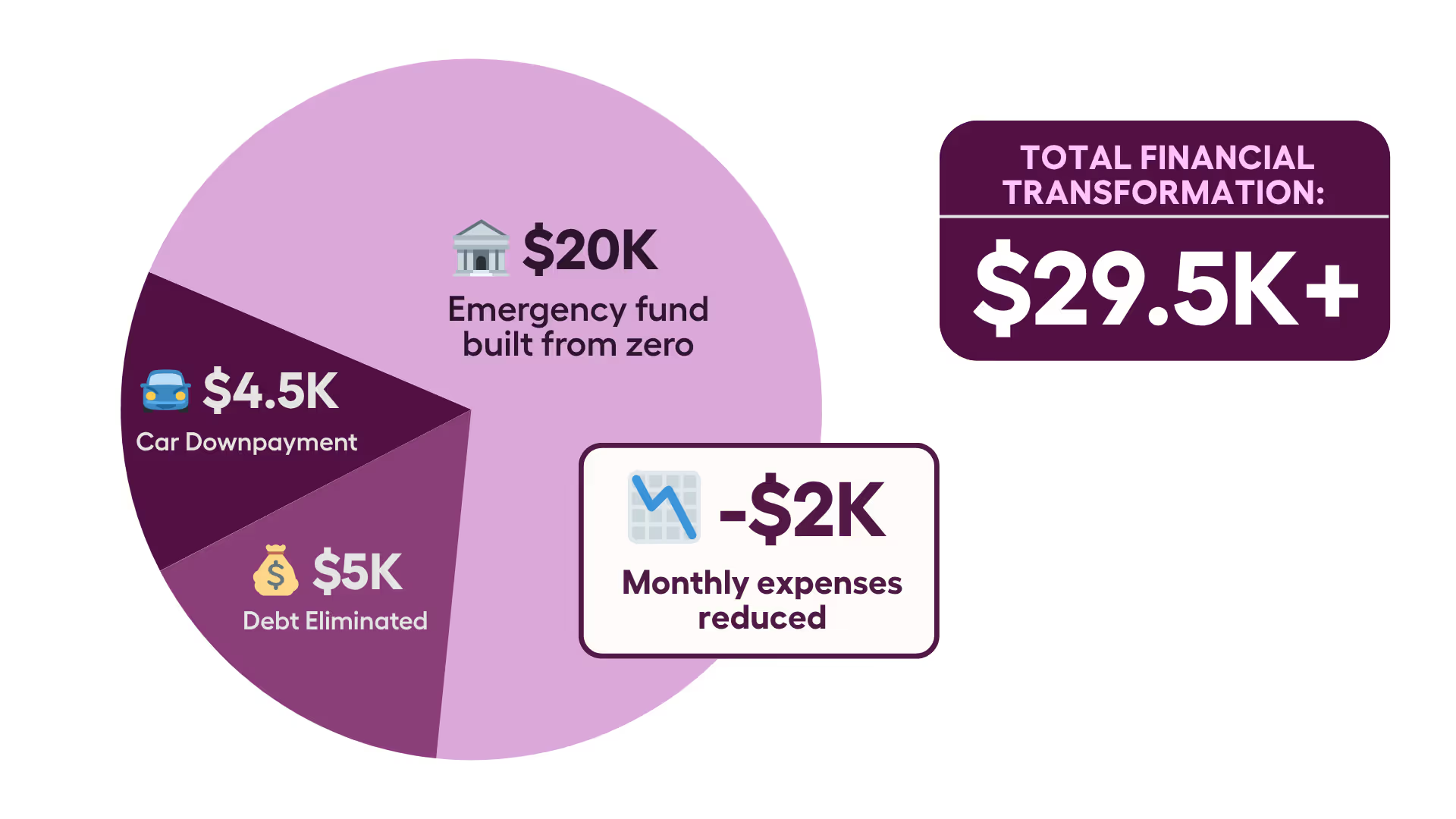

Erika's comprehensive action plan came to life. She tackled her $5K credit card debt and taxes while building systems to prevent falling back into old patterns. Her eating out spending dropped from $1,400 to $1,000 monthly - still allowing for the lifestyle she wanted, but within sustainable limits.

Check-in: Staying on track

Regular check-ins kept Erika accountable to her Doing Well Action Plan. She successfully reduced her monthly expenses from $5K to $3K, built her first-ever $20K emergency fund, and saved up $4.5K for a car down payment - all while staying focused on her esthetician business.

Instead of shame-based budgeting, Doing Well helped Erika understand her spending patterns and make conscious choices about what to keep and what to cut.

Knowing Erika's business demanded her full attention, they created automated bill payments and savings transfers that worked even when she was focused on clients.

Doing Well addressed the root cause of Erika's cyclic debt by building sustainable spending habits and emergency savings to prevent future financial stress.

The numbers tell only part of Erika's story. The deeper transformation happened in her relationship with money itself. No longer does she lie awake wondering if she's making the right financial decisions. The constant stress about money has been replaced with confidence and clarity.

"Now, I'm getting closer to my money goals, and I can finally breathe," Erika shared. "They helped me figure out where my money was going, set goals, and pay attention to my finances."

With her foundation secure, Erika can now focus on her bigger dreams: pursuing advanced aesthetics training, becoming a spa and wellness director, and eventually investing in beauty-related ventures.

"Look for areas where you can spend less and save some cash. Making a budget and sticking to it is key. If you need a hand, don't hesitate to reach out to Doing Well or someone you trust. Remember, even small changes can make a big difference over time. I usually keep my financial matters to myself, and I was unsure at first, but I'm happy I decided to give Doing Well a try.”

If you're struggling with debt and bad financial habits, you can get the same guidance that helped Erika break the cycle and build financial stability.